capital gains tax changes uk

Although no decisions have yet been taken a worst-case scenario for additional-rate tax paying. Have UK assets worth less than 150000 with the deceased having permanently lived outside of the.

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

18 and 28 tax rates for.

. This doesnt apply to your main residence or your car but it applies to most other things providing they are worth over 6000. HM Revenue and Customs HMRC has issued a reminder that the deadlines for paying capital gains tax CGT where there is a liability to do so after selling a residential property in the UK changed from 6 April 2020. The government has said it will consult on expanding this rule to cover the enhancing of land thats already owned and isnt currently covered by the current rules.

The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK. The additional tax falling due on the gain of 47500 could therefore be an extra 13300. For CGT to apply gains from the disposal of assets alone accumulated over a tax year must also.

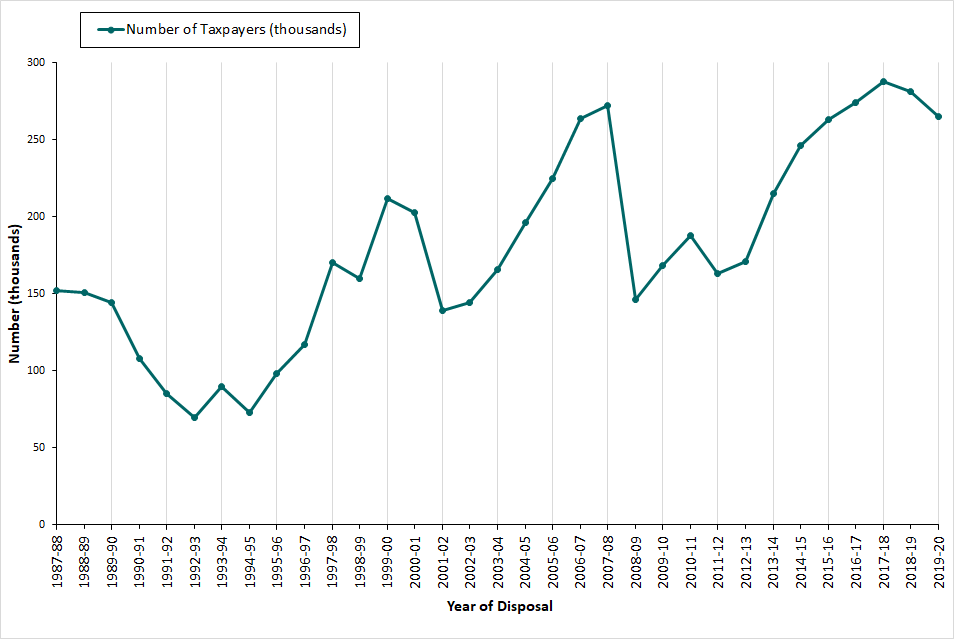

Once again no change to CGT rates was announced which actually came as no surprise. The Capital Gains Tax change gives property sellers more time to report the sale and pay due. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

20 on assets and property. If a persons taxable. From 6 April 2020 if you.

Capital Gains Tax changes that Self Assessment customers need to know. HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not. This comes after Chancellor Rishi Sunak asked the OTS to carry out comprehensive review of the capital gains tax system in July.

Implications for business owners. If youre registered for. The following Capital Gains Tax rates apply.

What are the changes. Its no secret that capital gains tax can be tricky to understand - thats why the OTS was asked to provide recommendations for improvement in the first place. The rate of tax you pay at each bracket also remains the same.

Find out moreNational Insurances rates. The same change will also apply for non-UK residents disposing of property. Since 6th April 2020 if youre a UK resident and sell a piece of residential property in the UK you now have 30 days to let HMRC know and pay any tax thats owed.

The capital gains tax-free allowance for the 2021-22 tax year is. You can use the service to report gains on assets you sold during the tax year. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report from the Office of Tax Simplification OTS.

Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts. If you dont HMRC can fine you. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do.

The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies. These rates are considerably lower than Income Tax which is charged at rates of 20 40 and 45. 12571 to 50270 Basic rate income tax of 20.

From 6 April any UK resident individual must now tell HMRC in cases where CGT is due and pay within 30 days from completion. Rumoured changes to Capital Gains Tax havent happened yet but politically it remains a soft target and we consider there to be a relatively high likelihood of reform this autumn or in spring 2022 said Mark Selby National Head of Corporate Finance with Azets the UKs largest regional accountancy firm and business advisor to SMEs. Dividend tax rates to increase.

Any gain over that amount is taxed at what appears to be particularly favourable rates with basic rate taxpayers paying tax at 10 or 18 on residential property and high or higher rate taxpayers only incurring. The changes in tax rates could be as follows. Class 3 1585 per week.

Report using the real time Capital Gains Tax service. The proposed capital gains tax reforms of which any Budget. Proposed changes to Capital Gains Tax.

50271 to 150000 Higher rate taxed at 40. Capital gains tax is intended to tax the gains made when you dispose of an asset that has increased in value. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28.

From 6 th of April 2019 non -UK residents will be obliged to pay NRCGT on both commercial and residential properties in UK. In our above example the amount of taxable gain has risen by 47500. Currently basic-rate taxpayers pay 10 CGT on assets and 18 on property while higher-rate taxpayers are charged 20 on assets and 28 on property.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. This could result in a significant increase in CGT rates if this recommendation is implemented. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

We also assume there is no annual exemption and the landlord pays tax on the gain at 28. Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. Similarly to the National Insurance rate rises those who earn money from dividends will also see a.

The Chancellor will announce the next Budget on 3 March 2021. 10 and 20 tax rates for individuals not including residential property and carried interest. Here is a breakdown of the income tax brackets on earnings for 2022.

150000 Taxed at 45. 10 on assets 18 on property. 0 to 12570 Tax-free.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains Tax Examples Low Incomes Tax Reform Group

Can Capital Gains Push Me Into A Higher Tax Bracket

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Capital Gains Tax Commentary Gov Uk

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

No Capital Gains Tax In The Netherlands The Taxsavers

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Commentary Gov Uk

Legally Avoid Property Taxes 51 Top Tips To Save Property Taxes And Increase Your Wealth Amazon Co Uk Iain Wallis Books Property Tax Inheritance Tax Legal